How Castrum Capital consolidated their operations with Spring

- Web3 Community

We provide infrastructure to simplify coordination of legal, token distribution, and operational processes—so communities can focus on growth.

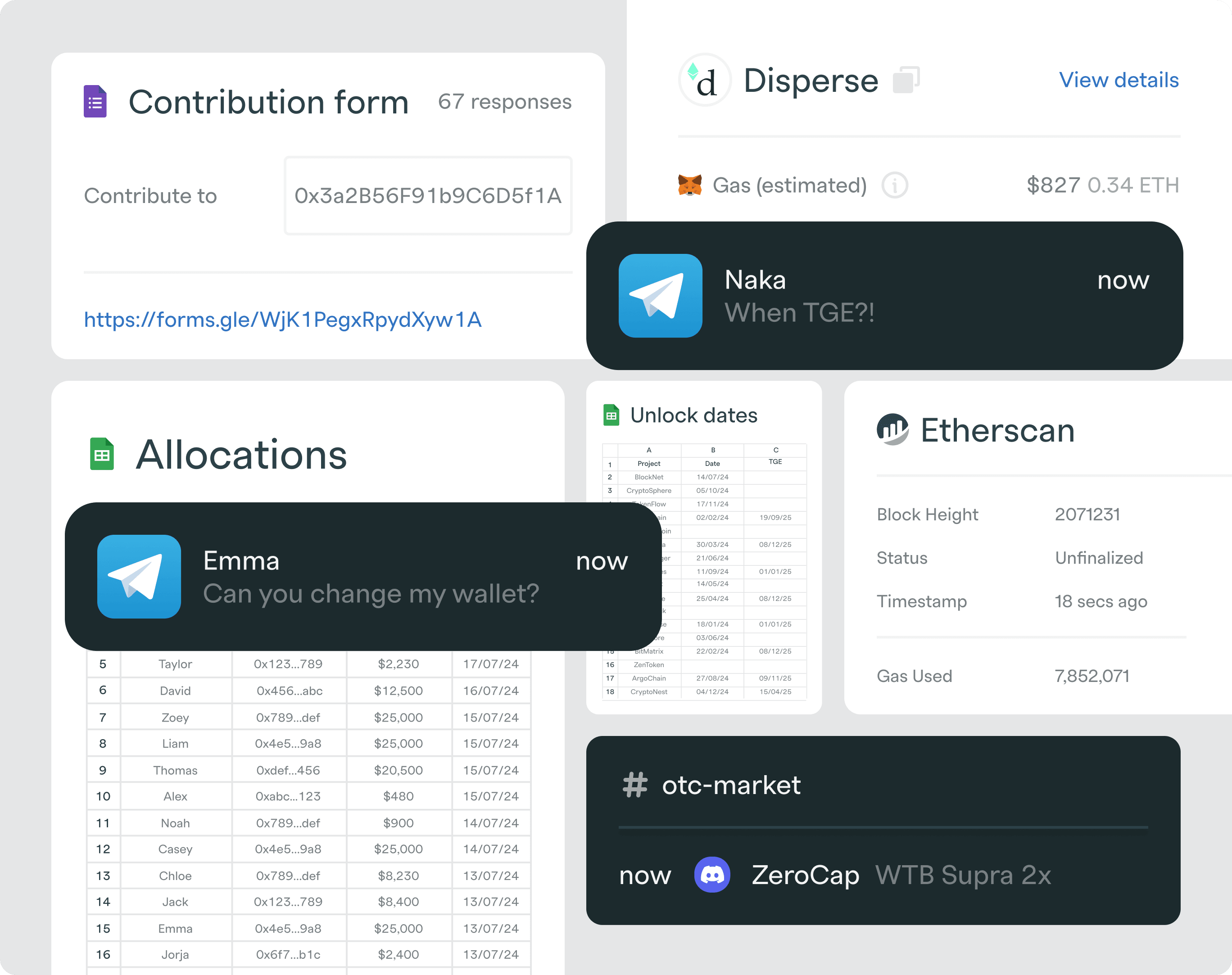

Managing a community is an operational nightmare. So most funds abandon the effort before it even begins, or is unable to scale.

We provide decentralized infrastructure to simplify coordination of legal, token distribution, and operational processes—so communities can focus on growth.

Customize your page with your logo and brand colors to create a platform that feels uniquely yours.

Automatically enforce the rules of your raise with powerful automation.

Collect funds reliably from members with an integrated DeFi payment system that automatically validates each contribution.

Participants receive tokens on time—automatically, and on-chain.

Your members are always updated in real time on all of their activity and progress.

Keep your members fully updated with automated notifications for every action taken.

Manage your syndicate and deliver a professional fundraising experience with your branding.

Import all your deals and active vesting schedules to Spring so you and your members can get started.

Utilize a system built for your team to easily tackle daily tasks like updating wallets, refunding tokens, or managing tiers.

Define your own risk thresholds, requirements, and screening rules— for every deal. Powered by 3rd party provider Persona.

Hundreds of thousands of users have coordinated token participation through Spring tools.

The trusted all-in-one platform for Web3 token communities and coordination groups.

The trusted all-in-one platform for Web3 token communities and coordination groups.